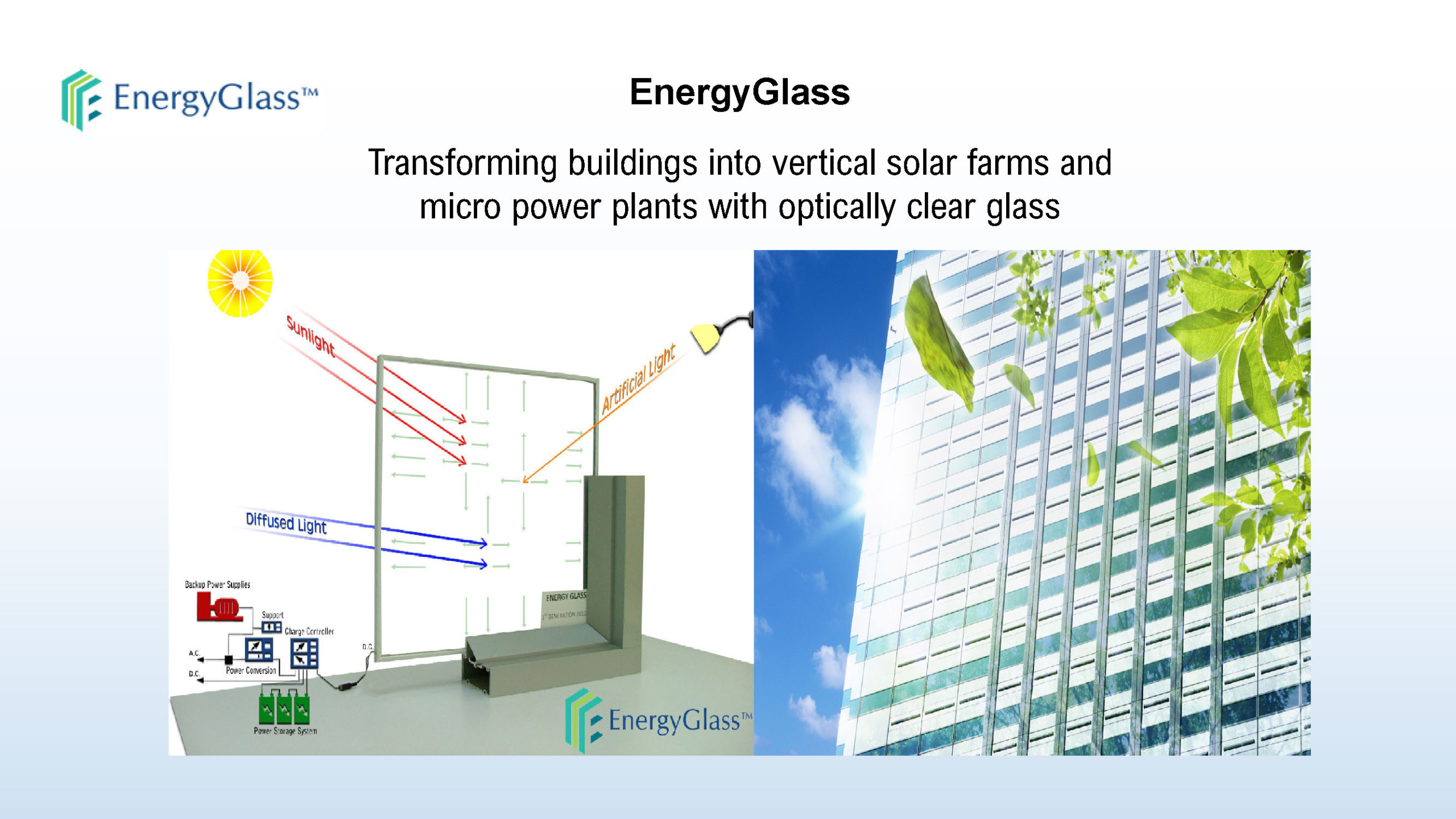

Through its Energy Glass subsidiary, Saf-Glas, using proprietary, patented Nano Technology, has developed an optically clear glass that produces continuous electricity form sunlight, diffused and ambient light, and ground reflectance. The entire surface of the window is clear with no grids, dots or lines and is the only known photovoltaic glass in the world with 100% field of vision.

RIVIERA BEACH, Fla., Aug. 12, 2021 /PRNewswire/ — Saf-Glas and Saxon Capital Group (SCGX-OTC) announced that they have entered into a non-binding letter of intent under which Saxon Capital will acquire Saf-Glas in a reverse acquisition transaction to be effected through a stock for stock exchange. Terms of the planned transaction were not disclosed.

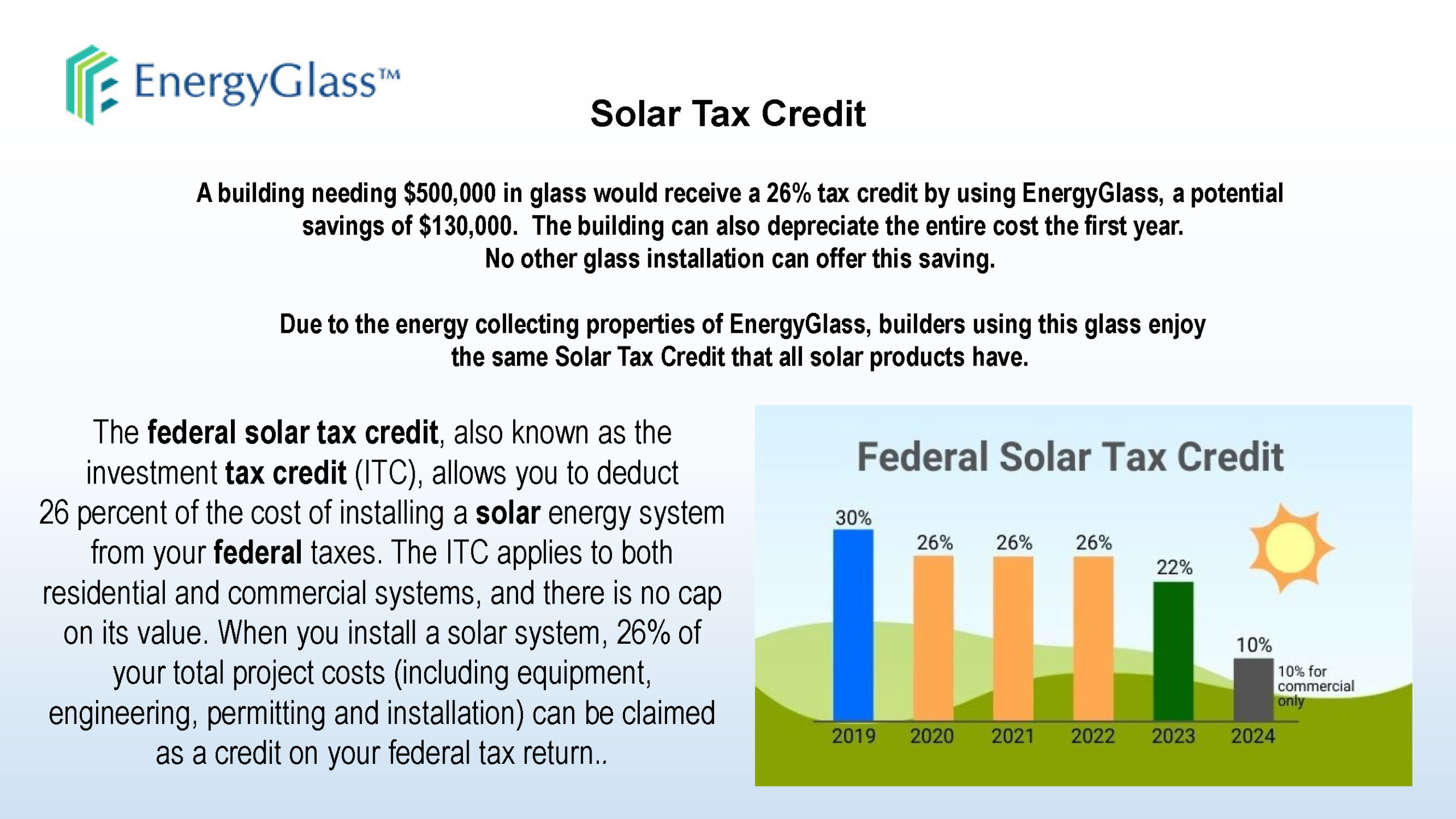

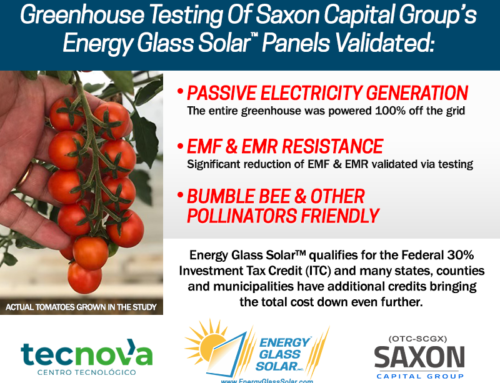

Saf-Glas LLC, is a 25-year-old glass producing company that has been developing and testing its patented Energy Glass product for approximately 10 years, receiving several 3rd party testing and certifications. Saf-Glas also produces Blast resistant, Bullet resistant, hurricane resistant and earthquake resistant glass that has been sold to Government and the private sector throughout the world. The combined company’s primary focus will initially be geared towards the Flat Glass Market, estimated to be $288 billion by 2025. Energy Glass is price competitive with standard laminated glass that does not produce passive electricity, and it also qualifies for certain tax incentives under current law. These tax incentives could provide building owners tax savings on the entire window system.

EnergyGlass Solar Tax Credit – A building needing $500,000 in glass would receive a 26% tax credit by using EnergyGlass, a potential savings of $130,000. The building can also depreciate the entire cost the first year. No other glass installation can offer this saving. Due to the energy collecting properties of EnergyGlass, builders using this glass enjoy the same Solar Tax Credit that all solar products have.

Energy Glass’s proprietary technology is produced by an affiliated laboratory which fabricates and refines a specific nano particle that, when co-extruded into the EnergyGlass™’ single source interlayer, has the ability to magnify and direct light, as well as remain visually clear. The light is magnified and then directed to the periphery of the glass plate, at which time the light is converted into electricity. The system components are interlayer, frame and frame architecture. The main proprietary element is an interlayer composition resulting from the co-extrusion of specific inorganic nanoparticles into the interlayer that redirects a portion of light to the periphery of the glass element where solar cells convert the light to electricity.

Energy Glass can incorporate many types of design elements, including tints, low E, insulated, reflective, and glass ceramic. It’s designed for windows, doors, greenhouses, transoms, sidelights, skylights, and any other design where transparency, protection, and electrical production are mandated. Energy Glass’ technology affords all of the benefits of any other glass, but also has the value add of producing passive electricity from sunlight.

The acquisition is subject to the satisfaction of numerous conditions, including satisfactory due diligence, the negotiation and execution of definitive agreements, board approval, and Saxon Capital Group completing a minimum $20 million equity raise concurrent with the closing. There is no assurance the acquisition will be completed.

Forward-Looking Statements:

Various statements in this release, including those that express a belief, expectation or intention, may be considered “forward-looking statements” that involve risks and uncertainties that could cause actual results to differ materially from projected results. Accordingly, investors should not place undue reliance on forward-looking statements as a prediction of actual results. The forward-looking statements may include projections and estimates concerning the timing and success of specific projects or transactions. Forward-looking statements may also include projections and estimates concerning our future operating results and financial condition. When we use the words “will,” “believe,” “intend,” “expect,” “may,” “should,” “anticipate,” “could,” “estimate,” “plan,” “predict,” “project,” or their negatives, or other similar expressions, the statements which include those words are usually forward-looking statements. When we describe strategy that involves risks or uncertainties, we are making forward-looking statements. The forward-looking statements in this press release speak only as of the date of this press release; we disclaim any obligation to update these statements. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. These risks and uncertainties include but are not limited to unsatisfactory due diligence results, and Saxon’s ability to complete a $20 million equity raise on acceptable terms, if at all.

Contact information :

Saxon Capital

Info@SaxonCapitalGroup.com

Saf-Glas/EnergyGlass

Info@EnergyGlass.com